Quick Thoughts

Discussion

I’ve just finished reading a book entitled “Bean Counters: The triumph of the accountants and how they broke capitalism” by Richard Brooks. It provides some very interesting insights into the history of accounting and the nefarious things unscrupulous accountants have been up to the last 800-odd years. Of course not all accountants are bad people, but it’s interesting to see how the accounting framework can be manipulated by those so inclined to do so.

One thing I really like about the book is the detailed look at the history of accounting, going all the way back to 1202 and how Leonardo Fibonacci (yes the sequence guy) was instrumental in getting the Arabic number system into schools in Italy, moving away from Roman Numerals and making things a whole lot easier for basic math calculations – as they state in the book – try dividing CDLXXV by XIX! This move proved to be revolutionary in commerce where they introduced an ingenious new accounting method called double-entry bookkeeping which has remained pretty much the same over these past 800-odd years.

Skip forward about 500 years and we get to Industrial Era Birmingham in the 1790s and James Watt and his partner Matthew Boulton are making steam engines. There are two key factors to their success – one is a separate condenser, the other is a new innovative accounting method called “job costing”. At this time there is not much of a market for steam engines that would enable them to set a price, so they decided to work out how much it actually costs to build the engines and then determine their own price to ensure a sufficient profit is generated.

Costing, and Activity-Based Costing (ABC) in particular, is all about the “job” or the work undertaken.

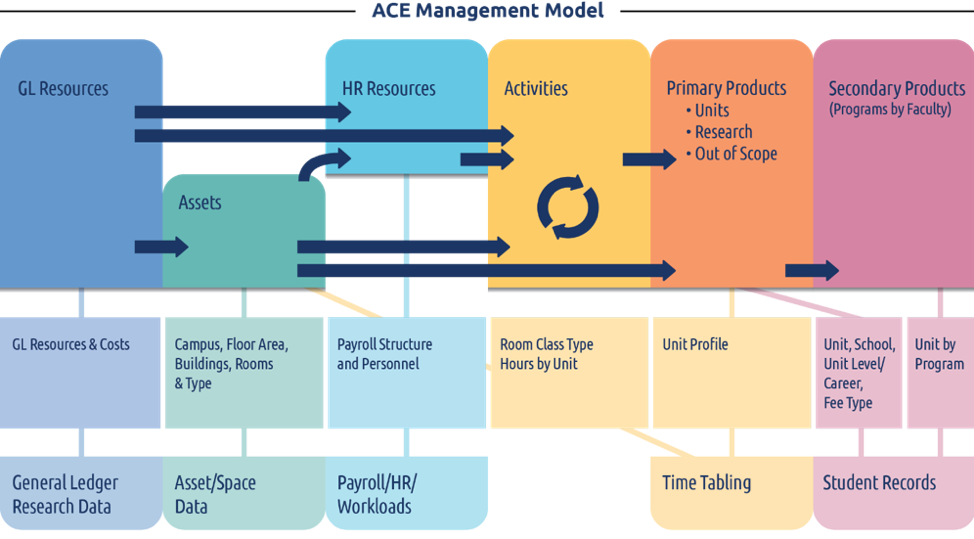

To build a proper ABC model the model builder needs to have a thorough understanding of:

- What work is done

- What resources are needed to support this work

- What products/services are produced

These models are management/operational/engineering models rather than accounting reports. The relationships built into the model are cause and effect relationships, not driven by Generally Accepted Accounting Principles. This is why it is very important to have management/operational/engineering expertise involved in building these types of models.

The data required to build these models come from a range of source systems and not just the Financial Management System.

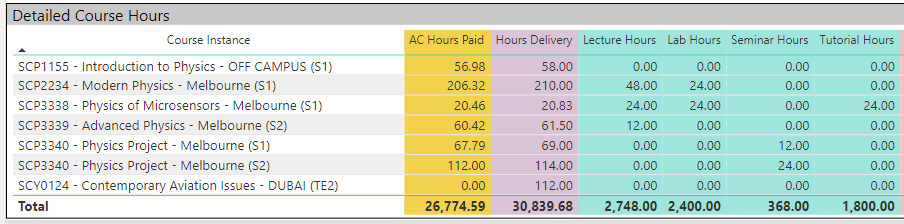

Higher Education

In the case of universities and colleges, the core work undertaken is teaching courses and/or conducting research. The academics know intimately what level of effort is required, what resources they need to undertake these tasks and what the end product is, so should be actively involved in the development of these models.

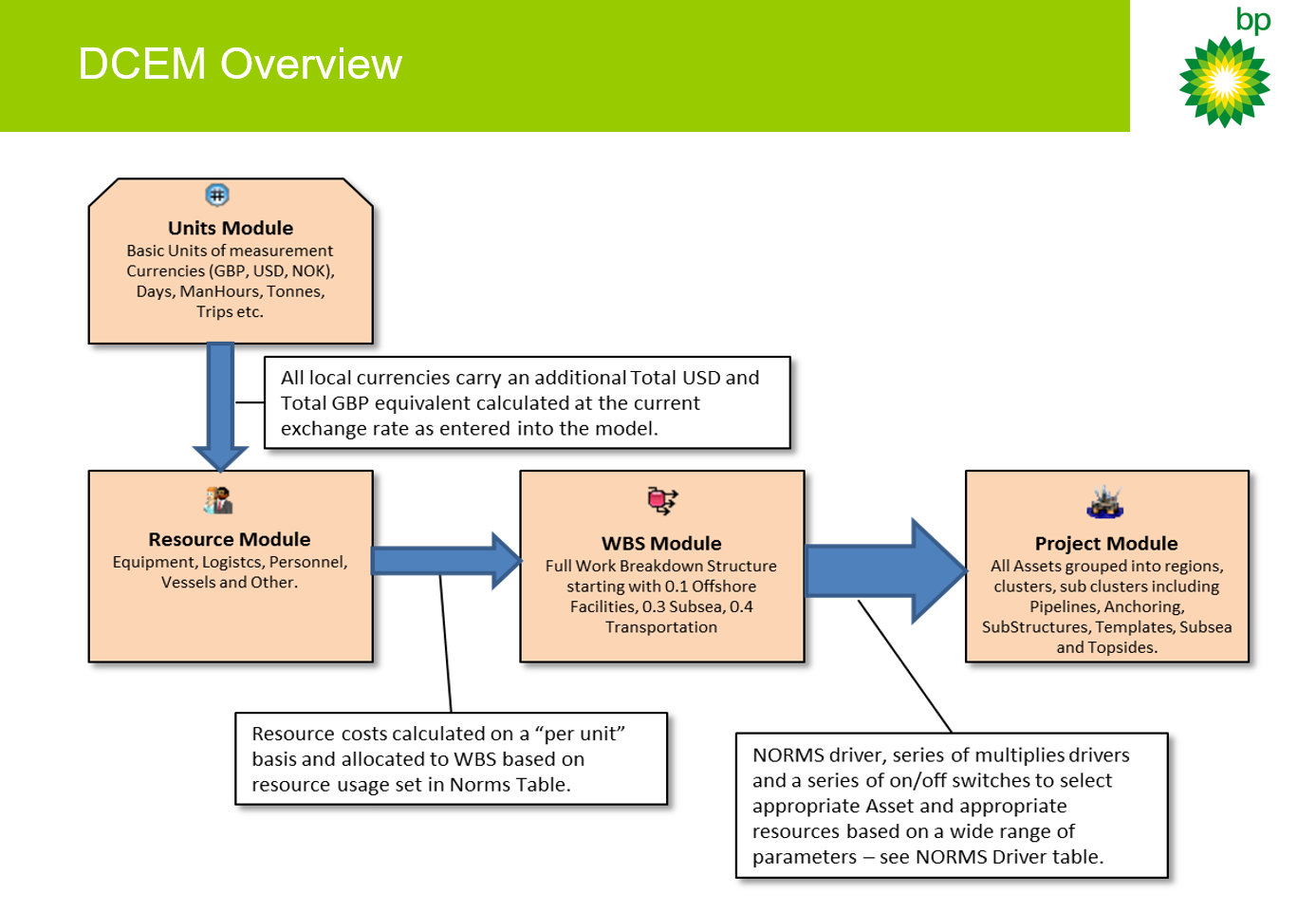

Oil/Gas

For our Oil/Gas Decommissioning models, the engineers/operators provide the Work Breakdown Structures, Resourcing requirements, Asset details, Unit Costs etc. This enables the development of the Decommissioning Cost Estimating Model which is used to calculate the full forecasted cost of Decommissioning particular Assets.

Telecommunications

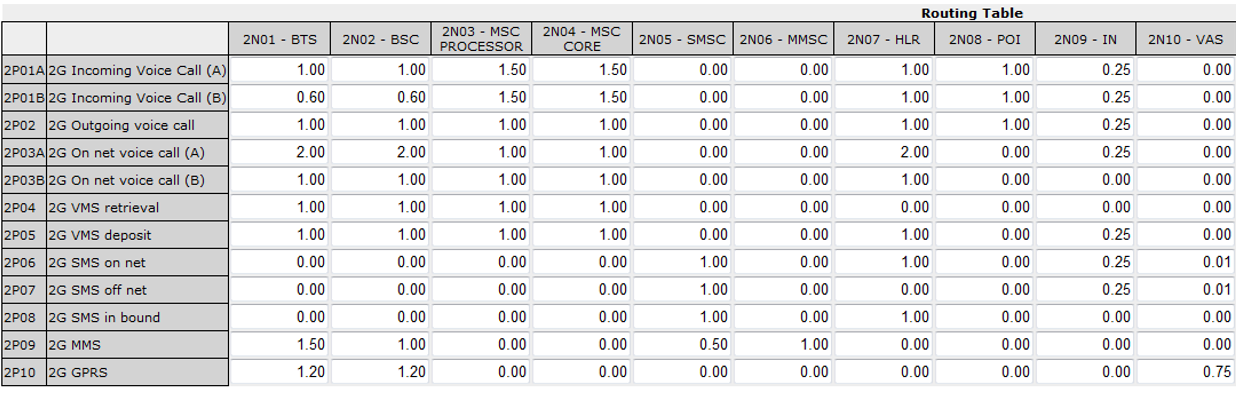

For Telecommunications models, engineers are required to provide all the complex equipment routing details for each type of call/service. This enables very detailed costing which is essential for working out appropriate pricing plans.

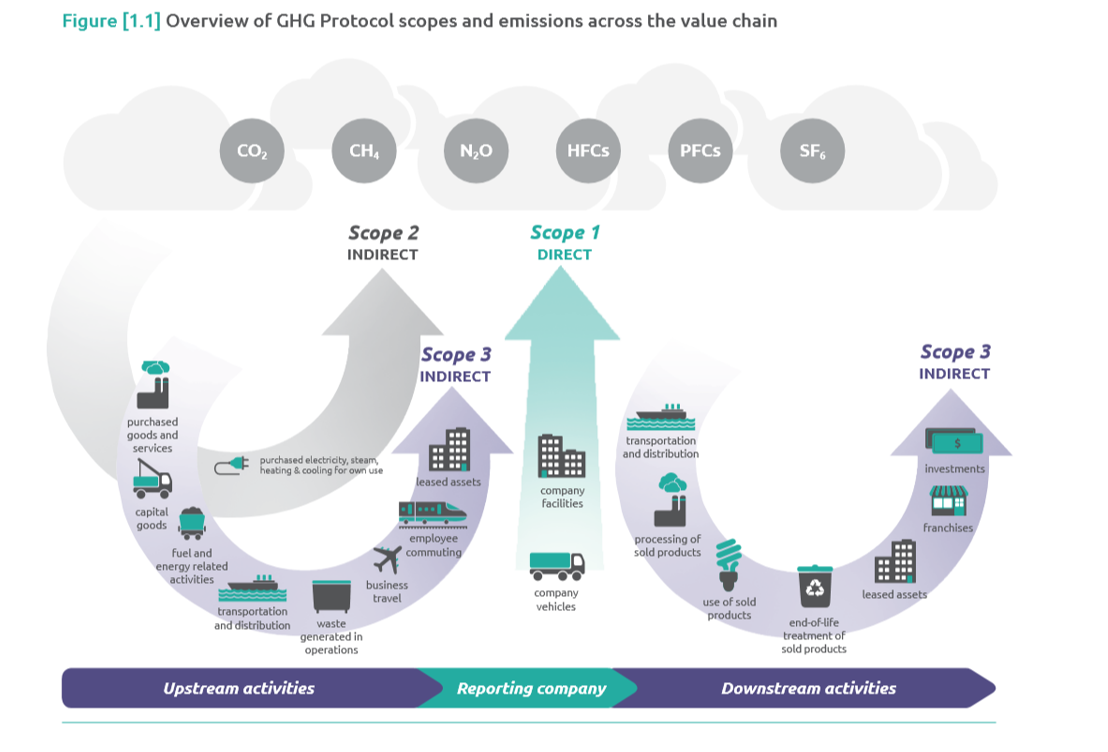

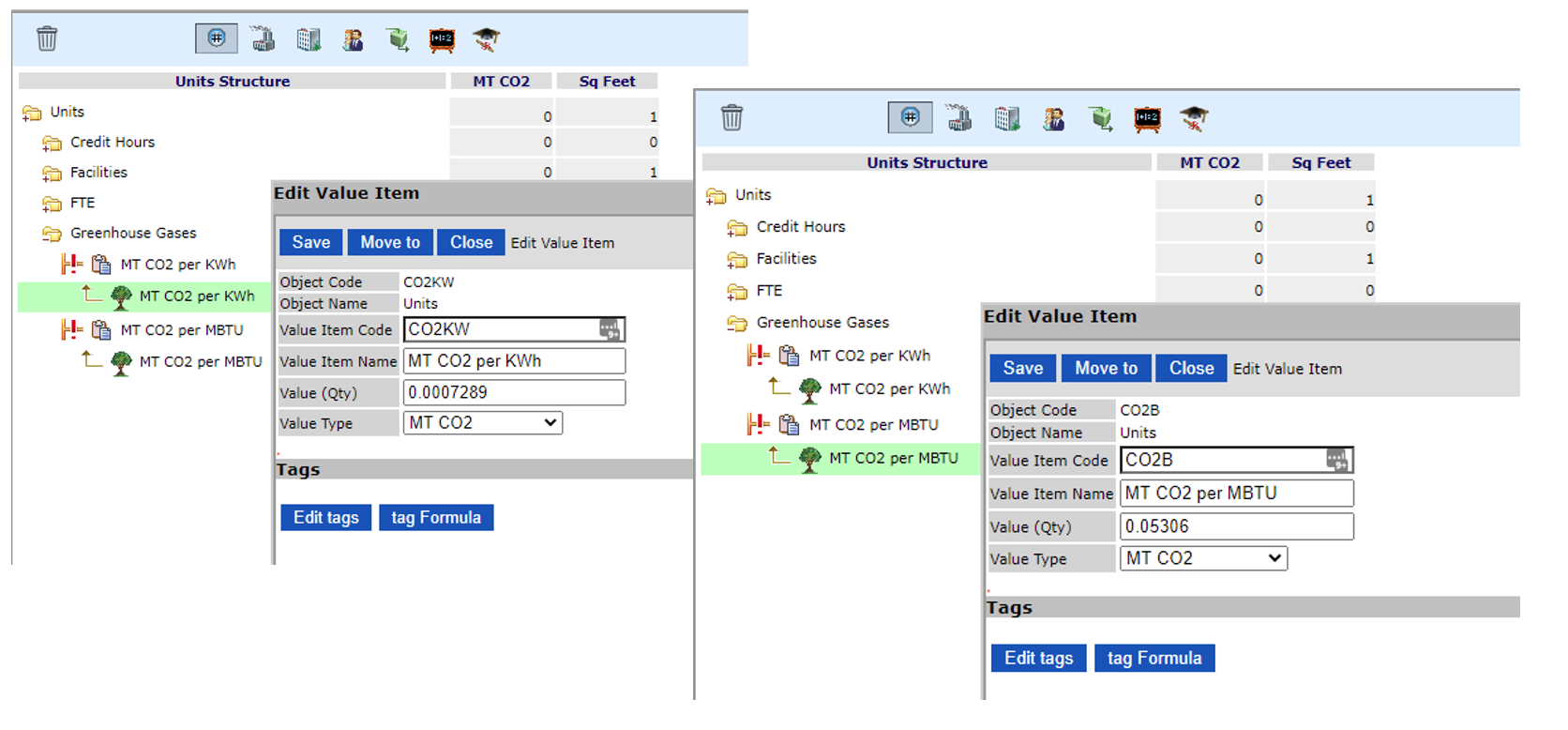

Environmental

Environmental Costing requires an understanding of the different types of Environmental Costs, how they are associated with resource usage inside the organization and what products/services they contribute to.

Final Thoughts

Costing is more than what is reported in the Financial Accounting system, it can absolutely reconcile to this system so that the total expenses in the Cost Model are the same as the Financial reports.

Costing is about the way these expenses (as well as Environmental Costs and/or Social Costs) are associated with Resources that are used to undertake work to create products/services using cause and effect calculation rules. So you need management/operational/engineering expertise to develop these cause and effect relationships.

Furthermore, when you have a thorough understanding of what causes cost, then you can use this to create predictive/forecasting models to feed into the strategic planning process. As you change processes, add new products, remove existing products, increase/decrease sales then you can quickly determine the cost impact and therefore the financial / environmental / social viability of the proposed strategies. The predictive models can also be used to stress test the organization by running a series of extreme scenarios to see what level of downturn in business could be withstood. Also, rather than setting budgets based on last year’s budget plus 10%, they can be set based on anticipated demand for specific products/services or anticipated changes to the business model.